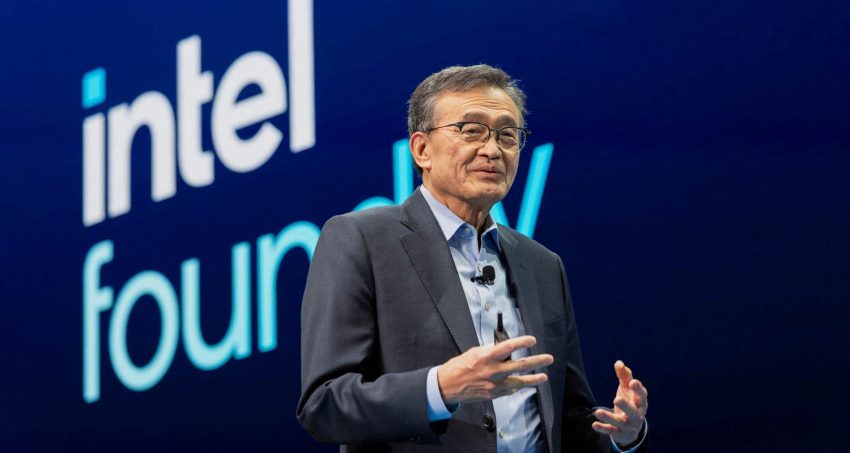

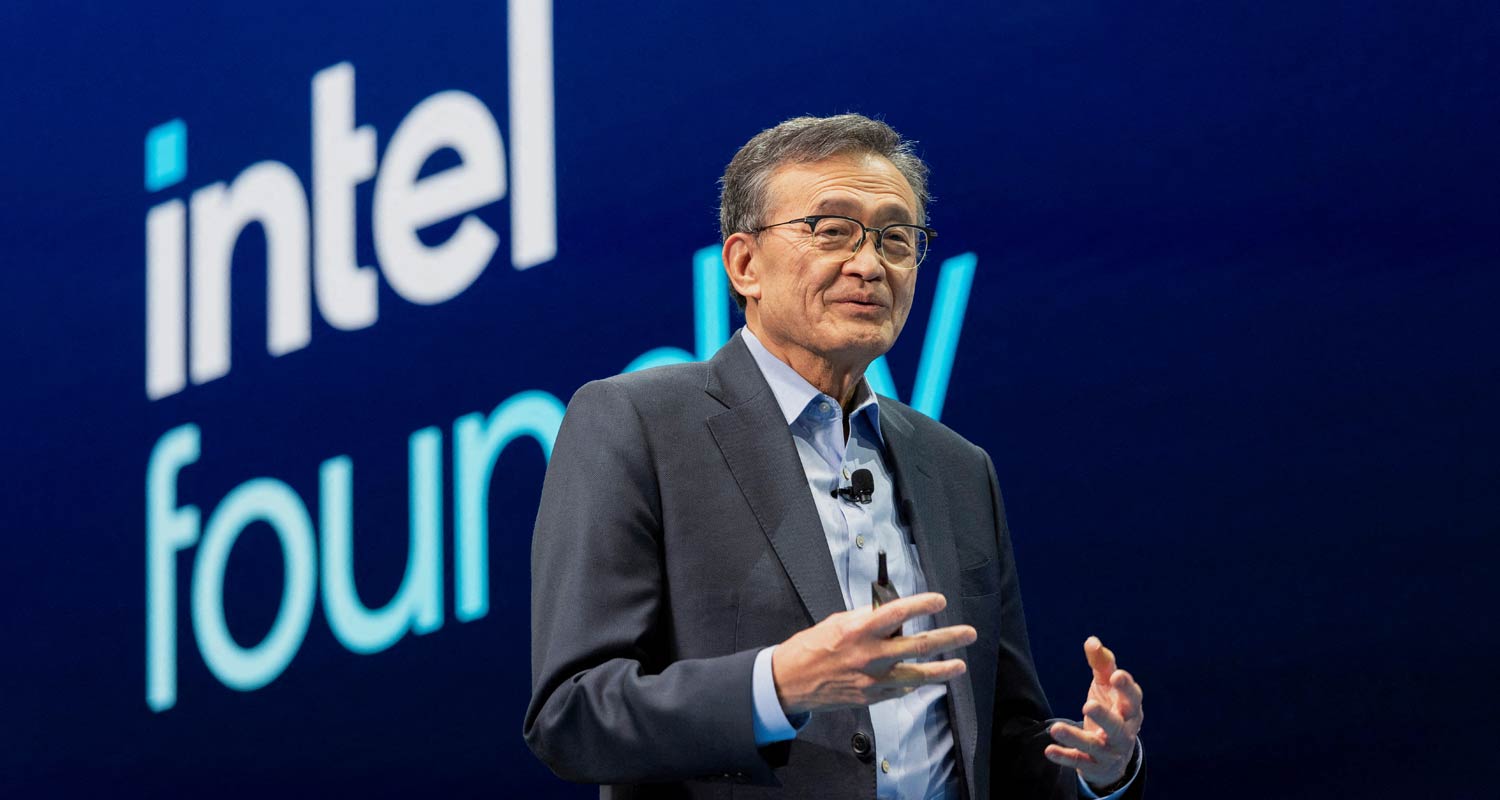

Intel is going to end the year with a workforce that is over a fifth smaller than last year, it said on Thursday, and new CEO Lip-Bu Tan presented a blueprint for a more cost-disciplined, streamlined chip maker that would issue “no more blank cheques”.

The job cuts — a majority of which have been completed already — are part of an effort by Tan since he took the helm in March to turn around the storied US chip maker. Intel has divested businesses, laid off employees and redirected resources.

The company has underperformed due to years of management blunders. Intel has virtually no foothold in the booming AI chip industry that is dominated by Nvidia, and its longtime rival AMD has been gaining share in Intel’s mainstay PC and server semiconductor markets. Its ambitious and costly plan for a chip contracting business that rivals that of Taiwan’s TSMC has failed to take off.

But Tan on Thursday signalled that he had taken charge of the company and was trying to wrest it back from what he viewed as previous missteps.

“There are no more blank cheques,” Tan wrote in a memo to employees. “Every investment must make economic sense. We will build what our customers need, when they need it, and earn their trust through consistent execution.”

But shares still fell 4.5% in extended trading after the company forecast steeper third-quarter losses than Wall Street estimated. Tan also told analysts on a conference call that he believes Intel’s so-called 18A manufacturing process — in which his predecessor Pat Gelsinger had deeply invested — could generate a reasonable return only if it is used for Intel’s own products. Reuters reported earlier this month that Tan is debating whether to quit offering that technology to external customers.

As part of the job cuts, Intel attempted to take a “surgical” approach and remove layers of middle management, finance chief David Zinsner said in an interview. “We took out about 50% of the layers of the company.”

Jobs bloodbath

The company is cutting its workforce by 15% from 96 400 that it reported at the end of June. It plans to further reduce headcount to 75 000 by the end of the year, down 22% from the end of 2024, which will be through attrition and “other means”, according to the company.

“They may have overspent on 18A … but I think this is the painted picture of a new fiscally disciplined base that they’re going to go from here. I think that’s the right approach,” said Ben Bajarin, CEO of tech market analysis firm Creative Strategies.

Read: Tan eyes 14A pivot as Intel rethinks foundry future

In the memo to employees, Tan said Intel is changing its strategy for building manufacturing capacity and now plans to build factories only when the demand for its chips is there. Previously, the company had built factories ahead of demand in the US and elsewhere.

Intel is now working to bring its 18A technology to high volume. Tan said in the memo that the company plans to take a disciplined approach to investments in the next-generation 14A manufacturing process, and in its quarterly securities filing, Intel said that if it fails to find a significant external customer for 14A, it may be forced to exit the chip manufacturing business.

Tan wrote the company now plans to slow construction work on new factories in Ohio and halt planned factories in Poland and Germany, and consolidate chip packaging operations in Costa Rica with its other packaging operations in Vietnam and Malaysia.

Tan wrote the company now plans to slow construction work on new factories in Ohio and halt planned factories in Poland and Germany, and consolidate chip packaging operations in Costa Rica with its other packaging operations in Vietnam and Malaysia.

“I do not subscribe to the belief that if you build it, they will come,” Tan said on the call with analysts. He later added that he will personally review and approve each of Intel’s major chip designs.

Intel said it expects a third-quarter loss of US24c/share, steeper than estimates of losses of 18c/share, according to data from LSEG. It expects revenue of $12.6-billion to $13.6-billion for the September quarter, with a midpoint of $13.1-billion that was higher than analysts’ average estimate of $12.65-billion. — Arsheeya Bajwa, Max A Cherney and Stephen Nellis, (c) 2025 Reuters

Get breaking news from TechCentral on WhatsApp. Sign up here.