Published

3 hours agoon

By

SA LIVE NEWS

The Global Wealth Report for 2025 shows an increase in global wealth, but unfortunately South Africa did not share in this growth, while the country continues to be one of the most unequal countries in the world. It did, however, see an increase in dollar millionaires.

UBS, a wealth manager and universal bank in Switzerland, compiles the Global Wealth Report with insights into personal wealth. The latest edition analyses 56 markets, estimated to represent over 92% of the world’s wealth.

The world’s wealth landscape continued to evolve In a year marked by shifting economic tides and the data in the report echoes this. According to the report, global wealth increased by 4.6% in 2024 after a 4.2% increase in 2023, but it also shows that South Africa experienced negative real growth in average wealth per adult in 2023 and 2024.

South Africa finds itself among the countries in negative territory for average as well as median wealth growth, alongside countries such as India, the UAE and Turkey.

ALSO READ: SA still the most unequal country in the world – Oxfam

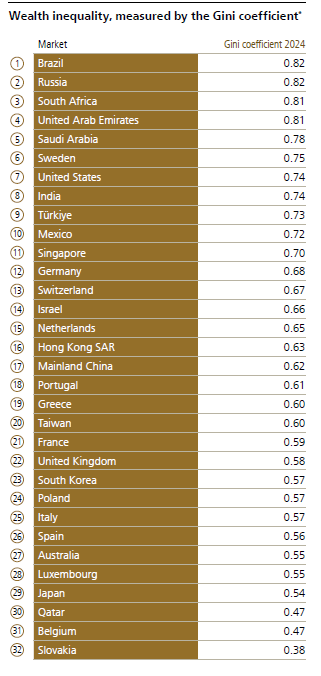

In addition, South Africa ranked third-highest in the world for wealth inequality, with a Gini Coefficient of 0.81, just behind Brazil (0.82) and Russia (0.82), and equal to the UAE.

This chart shows the wealth inequality in the world:

ALSO READ: Six South Africans on Forbes Real-Time Billionaire list

However, South Africa did see a positive increase in dollar millionaires with a growth rate just under 2% but still indicating increasing upper-tier wealth and supporting the wider Everyday Millionaire trend.

As an emerging market, South Africa is listed as one of the 15 emerging economies that collectively hold up to 30% of global wealth as of 2024, a statistic that has remained relatively flat since 2017.

Iqbal Khan, co-president of UBS Global Wealth Management, says the speed of growth was far from uniform, largely tilted towards North America, with the Americas overall accounting for the majority of the increase, with more than 11%.

“A stable US dollar and buoyant financial markets were key contributors to this growth. Asia-Pacific and Europe, the Middle East and Africa (EMEA) were lagging behind, with growth rates of below 3% and less than 0.5% respectively.”

ALSO READ: Where do the super-rich in SA live?

The 16th edition of the Global Wealth Report highlights these regional and demographic themes:

ALSO READ: Bill Gates explains why his children will inherit less than 1% of his wealth

This chart shows the change in total personal wealth from 203 to 2024:

Khan also points out that this year’s report highlights the rise of the Everyday MILLIonaire (EMILLIs), everyday millionaires with investable assets of between $1 million to $5 million. Their numbers have more than quadrupled since 2000, reaching around 52 million globally by the end of last year.

This group now accounts for approximately $107 trillion in total wealth, approaching the $119 trillion held by individuals with over $5 million in assets. Khan says the growth of this segment has largely been driven by increasing real estate prices and exchange rate effects.

“Despite regional differences, the long-term upward trend in the Everyday Millionaire group is visible around the globe.”

ALSO READ: Want to build wealth? This is how

The Global Wealth Report also highlights the differences in wealth distribution among generations in the US. It shows that Millennials (born after 1981) have the highest proportion of their assets in consumer durables and real estate and invest more heavily in private businesses.

Baby Boomers (born between 1946 and 1964) hold over $83 trillion in net wealth, far surpassing Generation X (born between 1965 and 1980), the Silent Generation (born before 1945) and Millennials.

Khan points out that globally, wealth allocation also varies, with the US standing out with its high allocation in financial investments, Australia in real estate and Singapore in insurance and pensions.

“Over the next 20–25 years, more than $83 trillion is expected to be transferred, with $9 trillion moving horizontally between spouses and $74 trillion moving between generations. The largest volume of wealth transfers is anticipated in the US of over $29 trillion, Brazil with nearly $9 trillion and mainland China with more than $5 trillion).

ALSO READ: Wealth gap widens, ANC dodges wealth tax

Robert Karofsky, co-president of UBS Global Wealth Management, says with global wealth expected to continue to grow, the ability to manage that wealth in a dynamic and complex financial environment becomes even more important, requiring strategic foresight and expert guidance.

Paul Donovan, chief economist at UBS Global Wealth Management, notes that wealth is not just an economic measure but a social and political force. “As we navigate the fourth industrial revolution and increasing public debt, the way wealth is distributed and transferred will shape opportunity, policy and progress.

“This year’s report underscores the evolutionary shifts in wealth ownership, especially the growing influence of women and the enduring importance of property and long-term asset trends.”