A new shiny car is not in everybody’s budget these days and car financers are trying to help them with balloon payments.

It is so tempting. That lovely shiny car will cost so much less per month and by the time the balloon payment comes around, you can always trade it in and pay off the balloon payment. And buy another new shiny car with its own balloon payment. How could this be a debt trap?

If you consider choosing a balloon payment when financing a new car, you are not alone. South African banks report that as many as a third of car loan customers choose the maximum balloon payment to reduce their monthly repayments.

However, Ernest North, co-founder of car and home insurance platform Naked, says it is wise to consider the long-term impact before committing to a balloon payment for your new car.

“Balloon payments have become increasingly popular in South Africa due to the rising costs of living, including the higher costs of car purchases and ownership. However, many consumers go for a balloon payment without understanding that they could get caught in a debt trap four or five years down the line.”

ALSO READ: Why balloon payments can become a burden – and how to manage them

Lower monthly instalments – that balloon at the end of the term…

North says although lowering your monthly repayments can help you to stretch your salary a bit further and potentially afford a better car, the lump sum at the end of the loan term is the sting in the tail.

“While a balloon payment can be a useful financial planning tool, many people find that they struggle to afford the final repayment.”

A balloon payment is a large amount that you agree to repay at the end of your car finance term, usually between 20% and 35% of the car’s value, with 40% being the maximum most banks would allow. During the term, you pay lower monthly instalments, but it is because you are not paying off the full loan, just a portion of it.

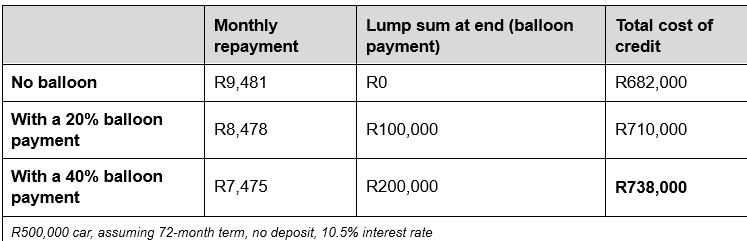

North says this might feel like a win, but warns consumers to consider the total costs of buying a R500 000 car on a six-year loan (assuming no deposit and an interest rate of 10.5%):

ALSO READ: Don’t get caught! Look out for these balloon payment traps when buying a car

What happens when the final car payment is due?

When the balloon payment is due, your options will be to:

- Pay it off in cash and own the car outright.

- Refinance the outstanding balloon payment by entering a new loan agreement and face another few years of making monthly payments and interest charges. You will also have to qualify for financing to take this option.

- Extend the loan term. Some lenders might allow you to stretch out your repayment period further, although this could mean paying even more interest. Again, this is only possible if you are creditworthy.

- Sell or trade in your car, leaving you without an asset after forking out cash for months. But remember, you must still settle the balloon payment.

ALSO READ: Need a new car? These are the payment options available to you

Risks of choosing a balloon car payment

North also reminds consumers about the risks of balloon payments. “These numbers and options make the significant risks and costs of balloon payments clear.”

He says the monthly benefit is actually very small compared to these future risk you take:

- Significant financial risk because you will either need to have cash to pay the balloon payment at the end or you will need to finance it.

- The bigger the balloon payment, the higher the interest you pay over the full term of the loan.

- After depreciation, your car might not be worth as much as the balloon payment at the end of the loan.

- You may never own a car outright if you get caught in a loop of refinancing via a balloon payment plan every five or six years.

- If you want to exit the loan early, you must be prepared for early settlement penalties and the outstanding balloon payment.

- Even worse, if your car is stolen or written off in an accident, you will be forced into an early settlement and will need to pay a massive shortfall.

- If you cannot afford the final payment, you could face consequences, such as repossession of the car under the National Credit Act.

“In theory, a balloon payment gives you the option to pay a large cash amount at the end of your finance term and then you can keep the car. But the reality is that most people do not have that kind of cash lying around and end up having to sell the car.

“And if the car’s value is less than the outstanding balloon amount, it becomes a very serious problem, one that many people are unfortunately facing.”

ALSO READ: Is it still worth buying a car?

Are balloon car payments really a good thing?

Do balloon payments then ever make sense?

North says despite the costs and risks, there are some instances where balloon payments can be a helpful tool in your financial planning:

- You like to trade your car in for a new model every few years and are confident you can afford the balloon payment when it is due.

- You can realistically expect your income and savings to increase over the loan term.

- You want a reliable new car with a warranty, rather than risking potentially higher and unpredictable maintenance costs with an older one.

- You are paying for the car through a business and can claim tax deductions on depreciation, interest, fuel, maintenance and potentially the balloon payment to help with cash flow.

- You do not anticipate needing to exit the loan early and are committed to keeping the car for the full loan term.

ALSO READ: The best way to finance your car

If you do, choose the right kind of balloon payment

Should you choose a balloon payment for your car, you will have to choose between guaranteed future value and traditional balloon payments. North says a Guaranteed Future Value (GFV) finance option could be a safer alternative.

“GFV agreements add a layer of financial security by guaranteeing the value of your car at the end of the finance term, regardless of how much it has depreciated. This guaranteed amount functions as your balloon payment (also known as the “optional final payment”) and is agreed upon upfront.

“When the finance term ends, you will have three choices: Make the final payment and keep the car, trade it in for a new car, or give the car back with nothing more to pay, even if its actual market value is lower than the GFV. This offers peace of mind and avoids the burden of being left with a car that is worth less than the lump sum you still owe.”

North also warns against using balloon payments to buy a car you cannot actually afford in the long term. “Rather put down a larger deposit or choose a more affordable car. Remember, a more expensive car will also have higher maintenance and insurance costs. While it can make sense in some circumstances, the downside of a balloon payment is very seldom worth the benefit.”