Year-to-date returns range from 90% to 161% for leading gold and platinum counters.

Gold and platinum shares have stolen the show on the JSE this year, with returns as high as 161% in the case of Sibanye Stillwater, helping power the JSE to new highs on Tuesday as the All Share index cracked 101 200.

“Much like the US’s Magnificent Seven leading Wall Street’s rally, South Africa boasts its own ‘Incredible 10’, says Kea Nonyana, market analyst at Scope Prime. “These ten stocks have been responsible for a remarkable 94% of the SWIX’s year-to-date gain of 20.8%, with the top three alone driving 52% of the advance. The top two are Gold Fields and AngloGold Ashanti, with platinum group miners (PGM) also leading the charge.”

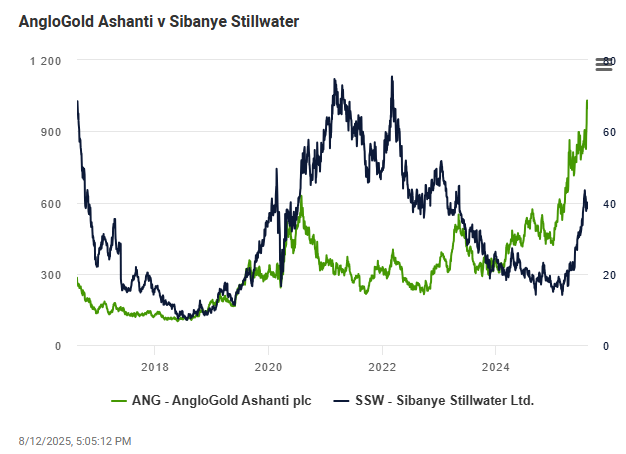

One of the big investment stories of the year has been the surge in precious metals, bringing respectability to the overall JSE performance. Besides Sibanye Stillwater’s surge, AngloGold Ashanti is up 151% so far this year, Gold Fields and Northam Platinum both up 128%, Impala Platinum 95% and Harmony Gold 90%.

“I don’t see gold back down again,” says TF Metals report founder Craig Hemke. “Gold has proven that its rally is sustainable and for sustainable reasons.”

Gold is up 28% this year, trading this week at $3 340 an ounce. Platinum is up nearly 50%, breaking above its previous 2022 high, with palladium clocking a 25% gain so far in 2025.

Gold’s surge since 2024 has been sparked by tensions in Ukraine and the Middle East, a weaker US dollar, central bank buying, and stubborn inflation in the US.

ALSO READ: JSE All Share Index hit 100k points

Mining stocks shine

Comparing the JSE’s average annual return over the last decade of roughly 11% with the S&P 500’s around 15% a year, suggests one would be far better off investing abroad. That said, there have been some spectacular performers on the JSE so far this year – most of them in the mining sector.

AngloGold Ashanti reported a more than three-fold increase in profits for the half year to June 2025, while Gold Fields’ recent trading statement says it expects a 203% to 236% increase in headline earnings for the six months to June 2025.

The JSE’s 24% year-to-date growth is driven largely by mining counters, with platinum and gold standing out, says Shiven Moodley, CEO of Novaque Research. “Platinum is up roughly 46% so far this year and gold 28%. The underlying drivers remain a blend of macro, geopolitical, and structural supply-demand dynamics.

“Geopolitical tensions continue to push safe haven flows. Central bank stockpiling is supporting gold with continued accumulation in reserves. Some could be attributed to demand shift away from gold to platinum for jewellery, while vehicle demand in this interest rate cycle supports the demand for catalytic converters for manufacturing. There is a potential headwind for South African production impacting supply,” adds Moodley.

ALSO READ: Why the sudden shine in gold again?

“For now, the precious metal market looks supportive of further upside, despite risk of de-escalation in geopolitical events. Platinum futures remain positioned as net long, supporting a bullish bias, however, we saw profit taking in early August. Gold remains net long, with contracts increasing over the first week of August, sighting a fresh conviction for bullish bias,” adds Moodley.

JP Morgan sees gold breaking $4 000 an ounce by the third quarter of 2026, should geopolitical risks remain elevated, while the metal has historically tended to perform well in times of a weak US dollar and lower US interest rates.

“We still think risks are skewed toward an earlier overshoot of our forecasts if demand continues to surprise our expectations,” said Gregory Shearer, head of base and precious metals strategy at JP Morgan.

“For investors, we think gold remains one of the most optimal hedges for the unique combination of stagflation, recession, debasement, and US policy risks facing markets in 2025 and 2026.”

This article was republished from Moneyweb. Read the original here.