Because we cannot immediately see the consequences of the US tariffs, it does not mean that there are none.

Global economic growth has been surprisingly resilient in a turbulent year, but despite this bit of hope to cling to, there are still many reasons not to feel safe, such as the impact of the United States (US) tariffs that came into effect this week.

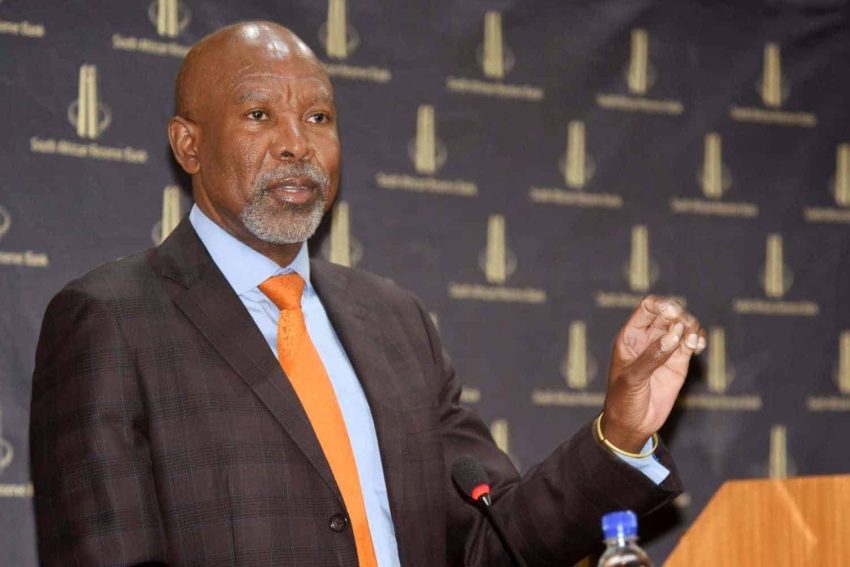

Lesetja Kganyago, governor of the South African Reserve Bank (Sarb) gave this warning, speaking at the 105th annual ordinary general meeting of the Sarb shareholders in Pretoria on Friday. He said so far, the global economy has proven resilient, despite the shocks from wars and tariffs.

“We should not overstate this. Late last year, the International Monetary Fund (IMF) still expected growth of 3.2% for 2025, which is now down to 3%. But in April, it was expecting 2.8%, which means we actually had some upward growth revisions.

“For all that happened in the first half of the year, it is surprising that growth held up this well and that forecasts are moving up rather than down. However, there are not many reasons to feel safe.”

Kganyago said US businesses front-loaded imports, while many have been in wait-and-see mode as a way of dealing with tariff uncertainty. He pointed out that it is now increasingly clear that tariffs will settle at high rates.

“The Yale Budget Lab calculates the effective tariff as of August at 18.3%, the highest since 1934. This implies significant price pressures that will have to be absorbed somewhere in the system. In this context, it is unsurprising that the US Federal Reserve has been keeping policy rates on hold, with the stance still somewhat on the restrictive side.”

ALSO READ: US tariff an existential threat for a third of metals and engineering sector

US tariffs and trade disruption not causing significant inflationary pressure on economic growth

In other regions, it has been clearer that trade disruptions are not causing significant inflationary pressure, he said. “The main concern has been that supply chain disruptions would push up prices, since most other countries took an enlightened approach and refrained from raising their own tariffs to match US measures.

“As the year developed, we saw mostly modest disinflationary effects, stemming from weaker demand and excess capacity. A weaker dollar has also been supportive of other countries, especially emerging markets. This gave many central banks the scope to ease policy rates and adopt more neutral policy stances.”

In South Africa, he said, the preliminary assessment is that tariffs and the other uncertainties in the global economy are causing modest damage to growth while leaving inflation broadly unchanged. However, he points out that the US is a large trading partner for South Africa, but not as important as Europe, China or the Southern African Development Community (SADC).

“Our exports to the US mostly consist of commodities, of which some are exempted, and manufactured products such as cars. Some parts of the agricultural sector are exposed, but total agricultural exports are only about 3% of our total exports to the US.

“For our latest forecast round, we factored in a higher tariff rate. This moved our growth projection lower for the year down by about 0.1 percentage points. This is a setback, but not catastrophic.”

ALSO READ: As if US tariff is not enough, more bad news for South African exporters

South Africa’s economic growth a bigger problem than US tariffs?

Unfortunately, Kganyago pointed out, South Africa’s growth rate for the year is still looking low, close to 1%. He says this continues a stagnation trend that has been in place for roughly a decade.

“The economy grew at about 4% a year during the 2000s, then slowed down steadily during the first half of the 2010s and has hovered at growth rates of about 1% ever since. As we have said repeatedly in our monetary policy statements, the drivers of weak growth are mainly structural and require structural reforms.

“Put in plainer language, without economic jargon, we need the trains to run and the cities to function. Given the reform momentum underway, perhaps best illustrated by improved electricity availability, we see some scope for better growth in the coming years.

“We also believe National Treasury’s efforts to stabilise debt can bolster confidence. In addition, the economy is enjoying some support from lower interest rates, with the yield curve shifting lower over the past year and our repo rate down by 125 basis points since September 2024.”

He acknowledged that South Africa, like almost all other economies, suffered high inflation during the global inflation surge of 2022 and 2023. “However, inflation decelerated sharply in 2024. We had space to ease rates because inflation has been well contained, with prices up 3% over the past 12 months.

“There have been notable risks to prices this year, such as the spike in oil prices after the bombing of Iran in June and the sharp depreciation of the rand back in April, but these risks were resolved quite rapidly and inflation has remained moderate.”

ALSO READ: Inflation increases in June as food prices increase to 15-month high

Inflation expected to increase soon, but expected to be temporary

Kganyago said inflation is expected to increase over the next few months. “Food inflation has picked up, mainly due to meat prices. Fuel prices are also falling more slowly now, compared to the recent past.

“However, we expect this uptick in headline inflation to be temporary, and we look forward to inflation coming back to around 3% over the medium term, which is at the bottom of our 3−6% target range.

“If inflation settles at 3% and inflation expectations continue their move lower, the Bank’s forecasting model shows lower interest rates if inflation remains contained at current levels. Given that this is the year of uncertainty, I do not want that projection to be mistaken for a promise. Events may not unfold exactly in line with our forecasts.”

Kganyago also spoke about the Sarb’s new strategy cycle this year. “One important change is that we streamlined our strategic focus areas to just three: price stability, financial stability and payments. These are the three integral functions of the Sarb: our fundamental value to society is money that holds its value and that can be used in a stable financial system to make payments efficiently.

“Elevating these three roles will help keep the organisation focused on its unique contribution to the well-being of South Africans.

“The South African economy no doubt has its vulnerabilities, but it also has strengths, and I am proud to say the Sarb is one of them.”