But with some conditions.

JSE-listed retail giant Pepkor has received the green light from the Competition Commission (CompCom) to acquire five retail store brands – Legit, Style, Boardmans, Swagga and Beaver Canoe – from the unlisted Durban-based group Retailability.

The CompCom confirmed the decision in a statement on Monday. It follows Pepkor and Retailability announcing the approximately R1.9 billion cash deal in March, which would include around 462 stores (within the five brands) across South Africa, Botswana, Lesotho, Namibia and Eswatini.

The CompCom said that it “recommended that the Competition Tribunal approves the proposed transaction whereby Pepkor Trading intends to acquire the target businesses [the five brands]”.

“The commission is of the view that the proposed transaction is unlikely to substantially lessen or prevent competition in any market,” it noted.

However, its green light comes with conditions.

ALSO READ: Pepkor to buy Legit, Swagga, Style and Boardmans

Conditions

“To address public interest concerns, the acquiring firm [Pepkor Trading] will employ the target businesses’ employees on terms and conditions that are no less favourable than the current employment terms and conditions,” the CompCom said.

“In addition, the acquiring firm shall not retrench any employees of the target businesses because of the merger.

“Lastly, the merged entity has also undertaken to maintain or increase the proportion of local procurement from small to medium enterprises and providers that are owned by historically disadvantaged persons,” it added.

When Pepkor and Retailability announced the deal earlier this year, the companies noted that the Edgars, Edgars Beauty, Red Square, Kelso and Keedo businesses “are not included in the proposed transaction and will continue to be operated by Retailability”.

Pepkor said at the time that the deal is driven by its intention to expand its market share in adult wear through organic and acquisitive growth strategies.

ALSO READ: Shoprite sells House & Home, OK Furniture to Pepkor

In its statement, the CompCom noted that “the primary acquiring firm, Pepkor Trading, is controlled by Pepkor Holdings Limited… Pepkor Holdings is a public company listed on the Johannesburg Securities Exchange [JSE] and is not controlled by a single shareholder.

“Pepkor Holdings controls a number of firms incorporated both inside and outside of South Africa… Pepkor Holdings has four operating segments but only two are relevant for the purposes of the proposed transaction.”

The CompCom said these include the clothing and general merchandise segments, which include all clothing, footwear and homeware retail brands under Pepkor Speciality; and the furniture, appliances and electronics segment under Pepkor Lifestyle.

It added that the “target businesses” are controlled by Retailability SA.

ALSO READ: Takealot sells online fashion retailer Superbalist

“The target businesses’ activities in South Africa are as follows: Legit sells ladies’ fashion/apparel and various beauty products. Swagga consists of Swagga/Beaver Canoe stores that sell apparel for men and boys.

“Style sells men’s and women’s contemporary and formal fashion wear, as well as kids’ clothing and cellular products. Boardmans consists of an online-only store selling appliances and homeware products,” the CompCom highlighted.

Retailability had purchased the Legit chain from Edcon years before the latter went into business rescue following the Covid-19 fallout. Later, during Edcon’s business rescue process, Retailability also purchased the Edgars chain for an undisclosed amount.

Edcon is now a defunct holding company, after Jet stores was also sold as part of the business rescue to JSE-listed TFG.

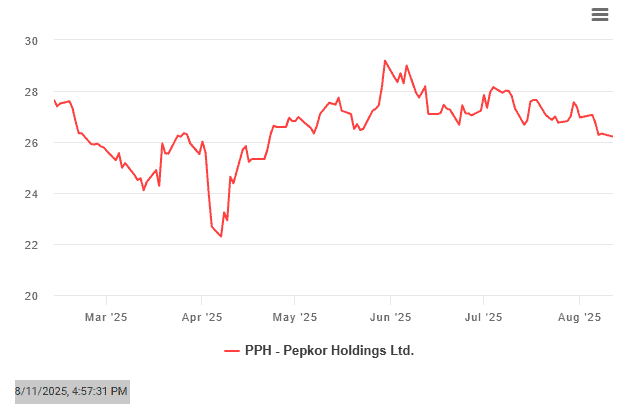

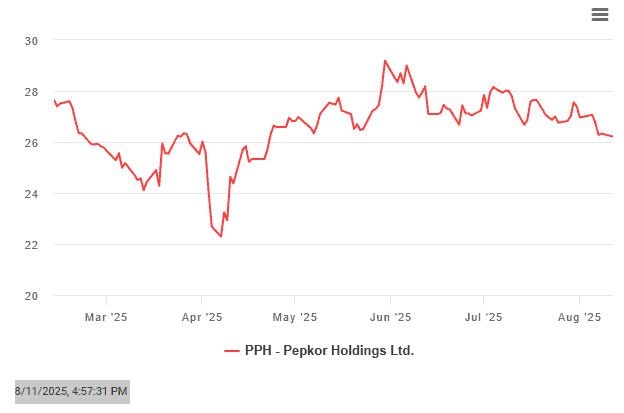

Pepkor’s share price

This article was republished from Moneyweb. Read the original here.