JSE- and Nasdaq-listed fintech Lesaka Technologies is involved in a corporate shake-up, including an internal rationalisation of its operating portfolio and an outward facelift of its brand identity.

Lincoln Mali, MD for Southern Africa at Lesaka Technologies, said the incorporation of recently acquired Bank Zero into the Lesaka stable – which still requires regulatory approval from the Prudential Authority of the South African Reserve Bank – is key to its strategy as it restructures to take advantage of groupwide synergies.

“Today we lend money – up to R1-billion to consumers and about R300-million in the merchant space, with both funded through borrowing from commercial banks. Tomorrow, when we have a bank, we will be able to use bank deposits to lend, which is much more efficient,” said Mali.

“In the way we now run the business, there are synergies across the group that each businesses unit benefits from, and Bank Zero will add to that.”

In recent years, Lesaka has gradually been acquiring fintech businesses, adding capabilities that largely remained in operational silos prior to the decision to integrate. These include the:

- R3.9-billion acquisition of cash management and growth capital specialist Connect Group in 2022;

- All-cash (sum undisclosed) acquisition of data analytics and software-as-a-service firm Touchsides in 2024;

- R1.7-billion spent acquiring payment processor and card acquiring platform Adumo;

- R507-million spent acquiring electricity and smart metering specialist Recharger; and

- R1.1-billion Bank Zero acquisition in July 2025.

As part of the integration, businesses that did not align with Lesaka’s new strategy, such as point-of-sale service provider Humble POS and enterprise sim distributor Nuets, were sold.

Read: Bank Zero to target a broader market with Lesaka’s backing

Mali said a key benefit of Lesaka’s new strategy is its ability to streamline costs and expand margins by having more of the services within the value chain of its consumer and enterprise businesses in-house. Also, the ability to offer enterprise customers a full suite of services across point-of-sales software, payments, lending and value-added services will have a positive effect on the group’s average revenue per user (Arpu).

‘Incredible’

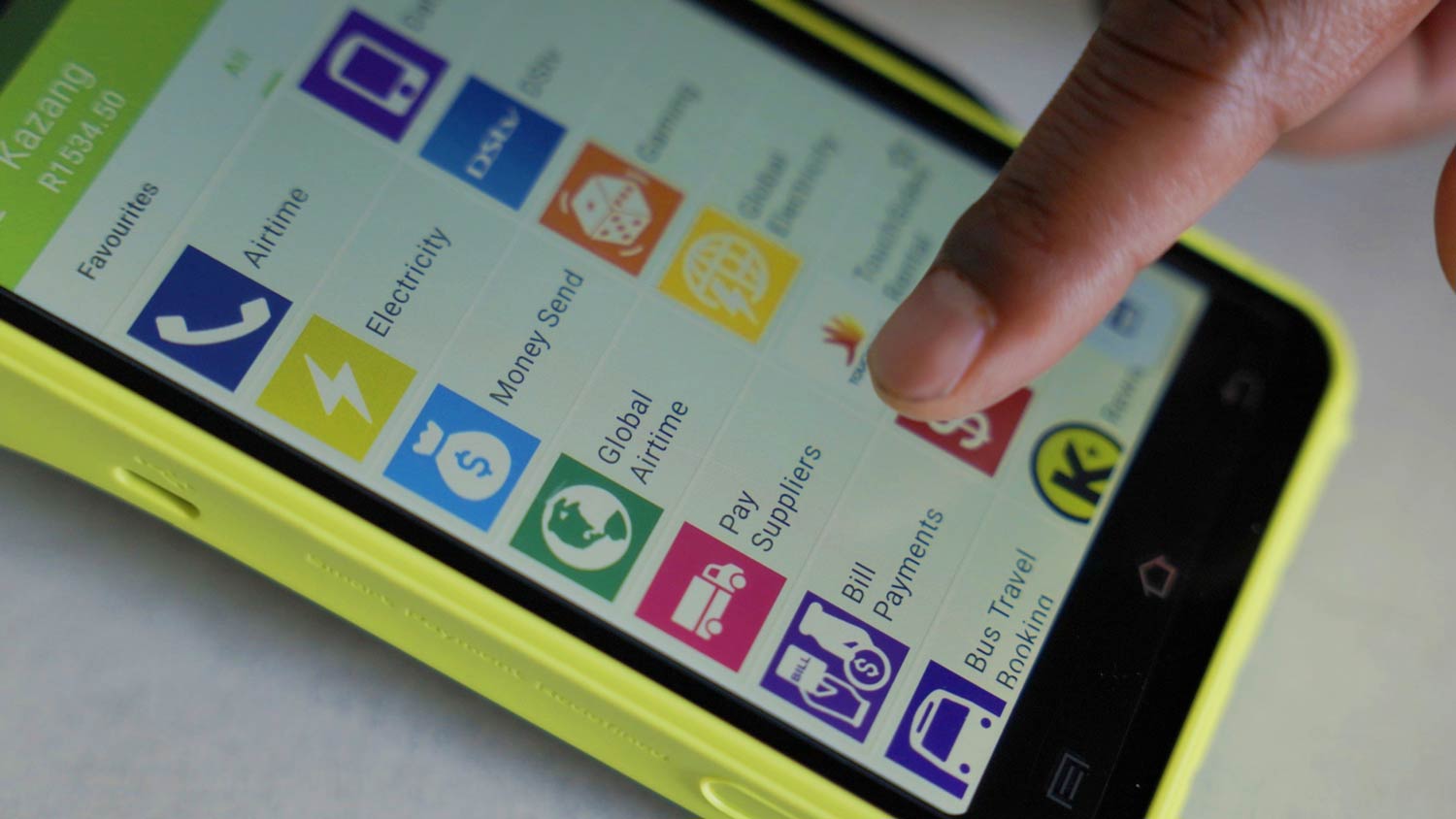

“The compounding effect and the impact on Arpu is incredible. Adding a service such as payments or lending on top of, say POS software, takes Arpu from just over R3 000/month to R5 000/month in the enterprise space. For informal market merchants such as taverns and spaza shops, that figure is from R550/month to around R950/month, simply by adding a payments layer,” said Mali.

To drive this new approach, Lesaka has begun training internal sales staff from its various businesses to understand capabilities across the group so they can spot opportunities for cross-selling and offer them to customers. Another important component of this strategy are the data and analytics capabilities housed in Touchsides, which offer the opportunity to use automation to spot enterprise and consumer clients who could qualify for lending and other products.

“The data is at the heart of it because that is how we know if we can offer one person an advance on airtime or electricity, and another a short-term loan to keep their businesses going,” said Mali.

Bank Zero’s addition into this ecosystem gives Lesaka the opportunity to add another channel for its services. The bank will also serve as an additional data source for the group’s analytics engine. Mali said one of the advantages of integrating with a neobank like Bank Zero is that it is built on modern architecture, unburdened by legacy architecture. This has allowed the Lesaka team to identify areas where the integration can easily get going once the regulatory nod is given.

In its second-quarter results to 31 December 2025, and released on Thursday, Lesaka reported a 3% year-on-year contraction in group revenue to R3.05-billion. Net revenue increased 16% year on year to R1.6-billion, while operating income surged 265% to R37-million. Mali said the company expects to see margins expand once its rationalisation exercise is complete.

Read: Commission clears Lesaka to buy Bank Zero

“The most exciting piece is that there is going to be one brand, and that is the Lesaka brand. That is a massive exercise because each one of those brands – Gaap, Kazang and Adumo, for example – have strong identities internally among the staff. In April, we start a massive brand campaign to introduce this to the market,” said Mali. – © 2026 NewsCentral Media

Get breaking news from TechCentral on WhatsApp. Sign up here.