It will come as no surprise to South Africans that their expenses over the past decade have far outstripped their income growth. However, seeing it reflected in the figures it quite startling.

Debt counselling and management company DebtBusters released its Debt Index for Q4 2025 yesterday, showing that electricity tariffs have increased by 165%, petrol prices by 74%, and the compounded impact of inflation (CPI) has been 49% over 10 years.

While consumers’ financial confidence may have improved in 2025, their debt levels have also risen significantly.

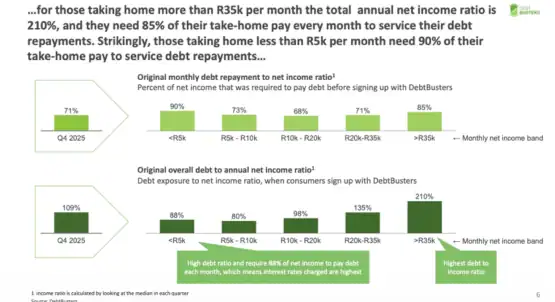

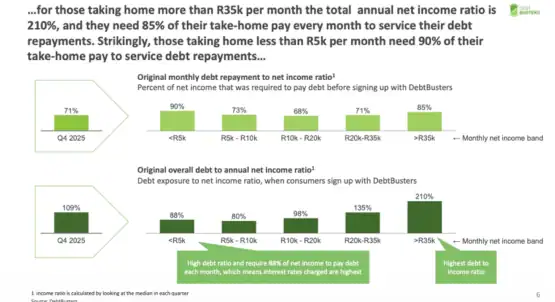

According to Benay Sager, executive head of DebtBusters, the level of take-home pay devoted to debt servicing is at its highest in almost a decade.

ALSO READ: Why cash-strapped South Africans were dismayed by repo rate decision

Consumers who applied for debt counselling in the fourth quarter of 2025 needed 71% of their take-home pay to service their debt.

“A record 96% of these consumers had a personal loan, and 59% had a one-month (payday) loan – another record,” he said during a virtual briefing.

“This indicates that personal loans, especially one-month loans, continue to be a vital lifeline as consumers supplement their income with short-term unsecured credit.”

He added that a worrying trend is the significant increase in the debt burden among high-income earners.

Unsecured debt among those earning more than R35 000 a month is 75% higher than in 2016, vastly outpacing inflation and net income growth. Sager says this level of unsecured debt is unsustainable.

Budget 2026

These figures underscore the sentiment that individual taxpayers cannot take on further tax increases.

Finance Minister Enoch Godongwana and government got a taste of that when they tried to increase the value-added tax (VAT) rate from 15% to 17% during last year’s budget fiasco.

Tax commentators agree that any Vat hike in this year’s budget, to be delivered on 25 February, is off the table.

The South African Revenue Service (Sars) has been working hard on its promise to strengthen debt collection and compliance efforts to avert tax increases in the 2026 tax year.

Godongwana reported in his November Medium-Term Budget Policy Statement that revenue collections for the first six months of 2025/26 reached R925 billion – 9% higher than the corresponding period in 2024. It was also R17.5 billion above the February 2025 budget estimate.

‘Silent’ increase

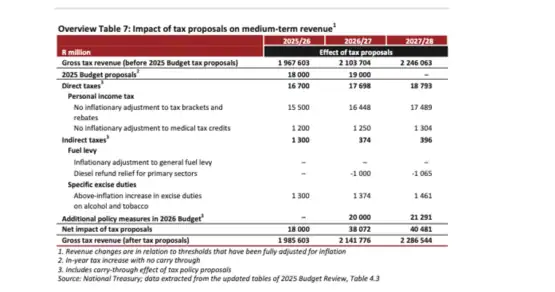

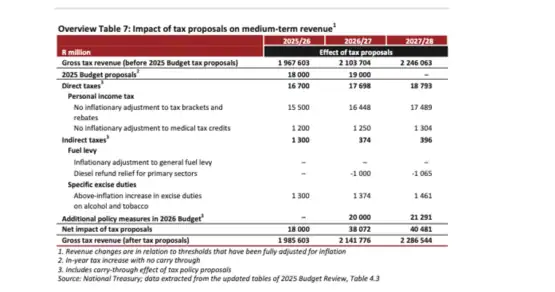

However, taxpayers should prepare themselves for a potential ‘silent increase’ in their tax load if Godongwana offers them no inflationary relief for bracket creep.

Mike Teuchert, tax partner at Forvis Mazars, says this silent increase was alluded to in the third and final budget of 2025.

National Treasury expects to collect R15.5 billion in 2025/26, R16.4 billion next year, and R17.4 billion in the outer year of the medium term if no relief for bracket creep is granted.

It also appears that medical tax credits could still be with us over the medium term, but taxpayers should not expect any inflationary relief. Sars will collect an additional R3.75 billion for no inflationary adjustments over this period.

Statistics from Sars released at the end of last year show a shift in the tax base towards older taxpayers, with younger people contributing little in terms of income tax.

This correlates with the high unemployment rates among youth aged 15-24 and 25-34 – at 58.5% and 38.4% respectively.

Deloitte associate tax director Mamohlwa Mohlola says it is critical to focus on efforts to raise youth employment levels to ensure they help carry the personal income tax burden.

It’s all about VAT

Lobbyists for VAT-free chicken are once again likely to be disappointed, as the possibility of an expanded zero-rated list seems highly unlikely.

Severus Smuts, indirect tax director at Deloitte, says Godondgwana made it clear that government will only expand the zero-rated items list if there is a VAT hike.

One issue that has been causing a lot of frustration is the stickiness of tax thresholds, particularly the VAT threshold for mandatory registration.

The R1 million threshold has not been amended in 16 years. A small business that crosses this threshold is immediately faced with a heavy administrative burden and an additional 15% cost increase if it cannot offset VAT.

Smuts says this frustration was raised at the annual South African Institute of Tax Professionals (Sait) Tax Indaba, where Sars officials participated in panel discussions. Deloitte has also made submissions to Treasury to have the threshold increased to at least R2 million, if not R3 million.

“There is a lot of lobbying happening for Treasury to increase these thresholds,” says Smuts. “It will alleviate the administration on small businesses and making sure that they can flourish.”

Teuchert notes that although some small businesses may initially go undetected, Sars will backdate registration to the date on which a business’s turnover exceeded R1 million once a return is filed showing that the threshold has been crossed.

This article was republished from Moneyweb. Read the original here.