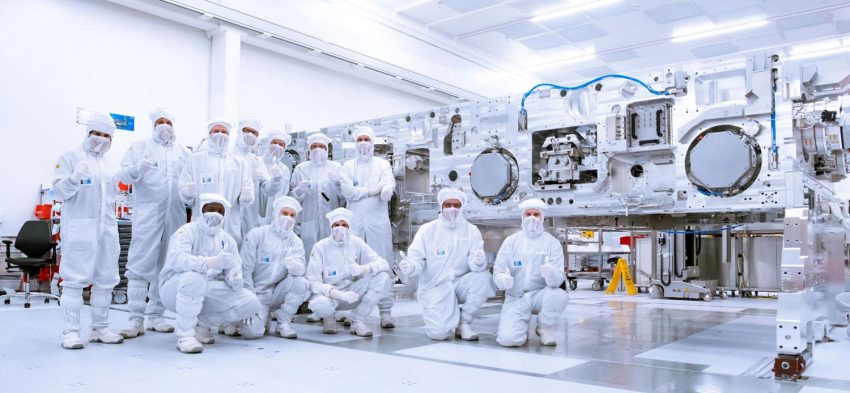

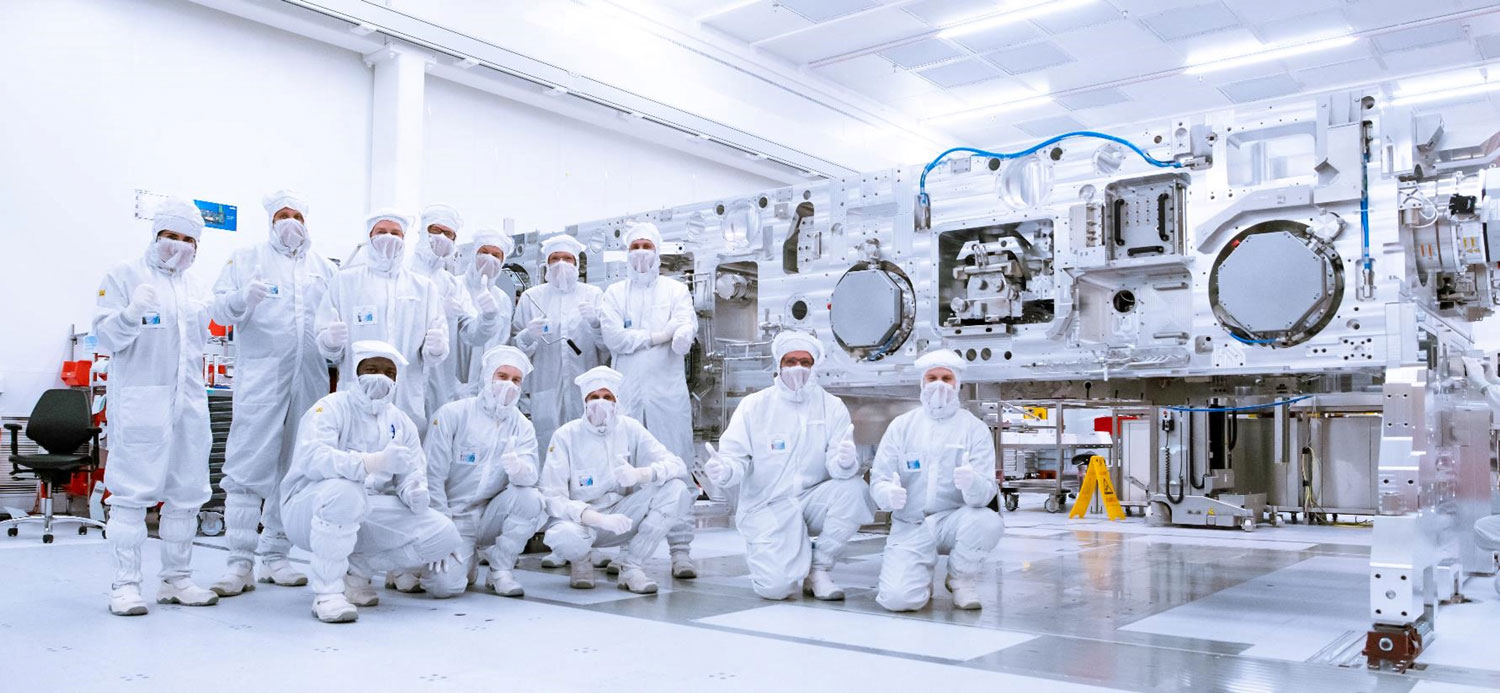

As artificial intelligence firms jostle for the Nvidia chips needed to power the AI boom, Dutch firm ASML has carved out a key niche in the supply chain: building the laser-using machines needed to print them.

ASML, which counts Taiwan’s TSMC and Intel among its clients, makes the huge precision machines needed to print the minuscule circuitry onto silicon chips, dominating the market for the high-end microprocessors needed for AI.

The Veldhoven, Netherlands-based company has seen its shares double in value since last April and rise 25% this month alone amid signs that its chip-maker clients are ramping up investment as a supply crunch pushes up chip prices.

Now investors are watching whether the firm ups its forecasts for flat-to-modest sales growth in 2026 when it reports earnings on Wednesday, analysts said. Analysts have been upgrading estimates as the stock races ahead, with new forecasts significantly above the company’s guidance.

A monopoly on extreme ultraviolet (EUV) technology has helped the firm ride the coattails of chip design giant Nvidia amid a global AI arms race that has created trillions of dollars in value.

ASML is “the only game in town”, said John West of semiconductor consultancy Yole Group, referring to EUV, which uses light beams just 13.5nm thick — minuscule, given a human hair is around 80 000nm to 100 000nm across.

The firm will also update its plans to ramp up the number of machines it can make.

Most valuable

Demand for ASML’s high-tech tools has made the firm Europe’s most valuable listed company with a market cap recently topping US$500-billion.

ASML controls some 90% of the market for lithography systems, analysts estimate, due to its high-throughput machines. It is the only maker of EUV technology, in which drops of tin are vapourised with lasers 50 000 times a second to create the light.

Demand for AI-linked cloud services boomed in 2025 and a related shortage of memory chips has started to push up prices for smartphones, computers and gaming consoles. Manufacturers are ramping up investment to boost capacity in response.

Read: The world needs Chinese chips: ASML

TSMC, ASML’s top customer, plans to increase capital spending by 37% in 2026 to $56-billion.

Analysts estimate Samsung is targeting a 24% hike to $40-billion, and that SK Hynix will increase spending by 25% to $22-billion, according to LSEG data. US firm Micron plans a 45% rise to $20-billion.

A quarter of chip-maker capex is spent on lithography, analysts estimate, largely going to ASML, and this proportion could be higher with AI chips, driven by demand from players like Apple, Google and Qualcomm. “We also foresee China business upside in 2026,” said Mizuho analyst Kevin Wang.

While ASML faces competition in the lower-end DUV — or deep ultraviolet — market from Nikon and Canon of Japan and SMEE of China, experts say its dominance in advanced chips is set to continue for years despite Chinese and US efforts to catch up.

Dan Hutcheson, senior fellow at TechInsights, who has followed ASML since it was launched out of Philips in the 1980s, said the chip industry is investing billions of dollars to adopt future generations of ASML tools. Changing course, he said, would be like swapping a Formula One engine mid-race.

Read: Honey, I shrunk the chips – inside TSMC’s 2nm breakthrough

“You have a whole supply chain that’s betting the farm on what’s going to be there five to seven years from now,” he said. With hundreds of billions of dollars at stake, companies are unlikely to switch vendors, he added. “Are you really going to risk all that on picking the wrong lithography tool?” — Toby Sterling and Nathan Vifflin, (c) 2026 Reuters

Get breaking news from TechCentral on WhatsApp. Sign up here.