The rand strengthened nearly 13% against the US dollar over the past year, yet the domestic numbers remain weak. That disconnect won’t last forever.

The ZAR traded at R16.51 to the USD last week, capping off a 13% rally against the greenback over the past year.

In the same week, the Absa Purchasing Managers’ Index (PMI) shows a manufacturing sector in deep trouble, with the index declining by 1.5 points to 40.5 in December – its lowest level since the Covid shock in 2020. An index below 50 signals a contraction in economic activity. Above 50, the economy is expanding.

There’s a clear disconnected between the ZAR-USD exchange rate and weak economic fundamentals at home. Lower inventories and a decline in the employment index were the main reasons for the PMI drop.

There seems little evidence that lower interest rates and declining inflation are showing up on the factory floor.

Minerals exports reported an exceptional year, primarily from rocketing precious metals prices. Elsewhere, it was a different story.

ALSO READ: US strike against Venezuela had little effect on markets and none on SA

SA’s once mighty steel and chrome manufacturing sectors have been consigned to government’s frail care unit, with urgent plans to introduce reduced electricity tariffs to keep them afloat.

RThis is part of a package of measures intended to reverse the deindustrialisation of SA.

Other measures include a proposed new tax on chrome exports and a block exemption under the Competition Act to allow distressed industries to collaborate in areas such as infrastructure sharing and energy purchases, without violating anti-trust rules.

Despite recent improvements at Eskom and the Transnet rail network, the decades-long neglect at both these state-owned companies has stifled growth.

ALSO READ: Is volatile geopolitics good for the gold price, rand and JSE?

Global vs local factors

Kea Nonyana, market analyst at PrimeXBT, says the rand’s fundamentals are being driven far more by global factors than domestic fundamentals.

“A weaker dollar, improved risk appetite and South Africa’s still-attractive carry have supported the ZAR, even as local activity indicators like the Absa PMI point to a very weak real economy. It’s a reminder that the forex market is pricing global liquidity, not domestic growth and that disconnect won’t last forever.”

Shiven Moodley, macro strategist at financial advisory Novaque, says USD softness rather than strong fundamentals are behind the ZAR’s recent strength. The forward market shows that this trend might continue a little while longer, but over three to six months, rising risk premiums for locking in exchange rates at today’s prices are significantly higher.

“That suggests some nervousness over the sustainability of the ZAR’s rally.”

Factors playing out in the US are likely to have a fare bigger impact on the ZAR, adds Moodley.

“We have some employment data out from the US this week. This could be significant. There is a thing called the ‘Sahm Rule’ [a recession indicator developed by economist Claudia Sahm], which in economic theory explains that a recession generally follows if the three-month average unemployment rates rise more than half a per cent above the 12-month low.

“That narrative switch by markets, if recession fears creep in, would spur a risk-off tone, impacting ZAR gains,” says Moodley.

ALSO READ: Construction activity best in 11 years, but S&P PMI disappoints again

There are pressures from US President Donald Trump on the Federal Reserve to continue lowering interest rates, and that, too, will keep the ZAR on the front foot, adds Moodley.

Writing in December 2025, Investec chief economist Annabel Bishop noted that the rand has largely ignored developments domestically. While it strengthened against the USD, it remained essentially flat against the euro and British pound.

“The rand has essentially been flattish this year and last year against the US dollar on average, and over 2026 is expected to pull somewhat stronger, but not see very substantial strength currently,” says Bishop.

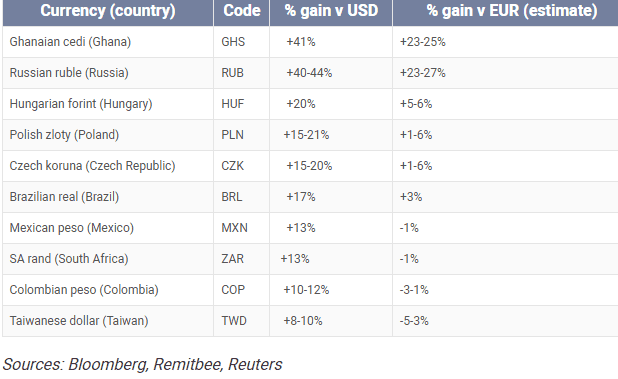

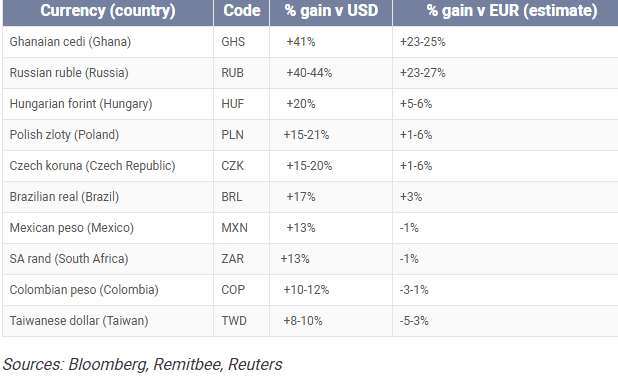

The USD weakened against most emerging market currencies over the past 12 months, but less so against the euro, as the table below shows.

ALSO READ: Absa PMI for December signals manufacturing still under pressure

GDP growth for the third quarter of 2025 was 0.5%, down from the revised 0.9% reported for the second quarter.

Projections for 2026 range from 1.1% (according to the International Monetary Fund) to 1.7% (according to PSG Financial Services).

Inflation dropped to 3% in December 2024, increasing to 3.5% by November 2025 with the trends suggesting the South African Reserve Bank’s hard 3% cap is within reach.

The latest Absa PMI index isn’t all bad news, as reflected in the business activity index – which increased by 9.4 points to 46.1 in December, up from 36.7 in November. This is still below the 50 mid-point where it remained for 11 out of the 12 months for 2025.

The PMI component indices for new sales, employment and expected business conditions remain subdued.

This article was republished from Moneyweb. Read the original here.