Volume traded was nearly 10 times the daily average over the past year.

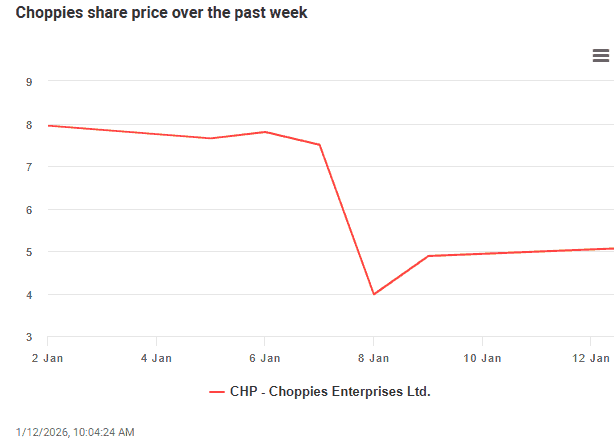

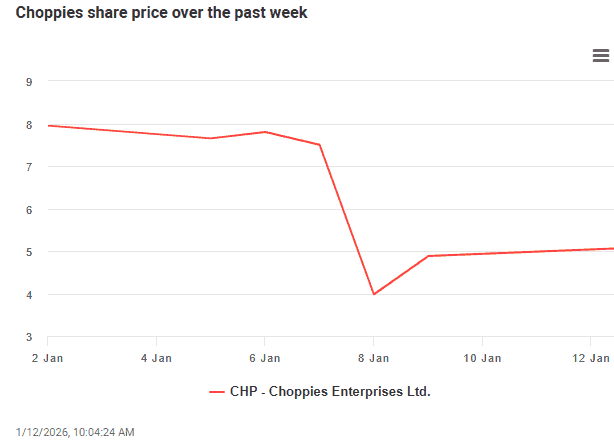

The top-performing share of 2025, Botswana retailer Choppies Enterprises, which was up 891% (915% on a total return basis) across 2025, tumbled 47% on Thursday (8 January) on no obvious news flow.

The share closed at R3.98, having traded as low as R3.21 intraday, which represented a decline of 57%.

Stunningly, just over one million shares were traded on the day – around 10 times the daily average over the last 52 weeks.

The entire story of Choppies in 2025 is quite surprising, with the share rocketing from 80c in January to nearly R8 at the end of December.

As Moneyweb reported on Monday, “the share had doubled from 80 cents in January to R1.60 by June, then started to run hard after the publication of the group’s results for the year to June 2025 in the last week of September. By November the share price had doubled again, and a few weeks later it did so again”.

This is astonishing for a share that is so thinly traded and which was valued at the start of 2025 at just under R1.5 billion.

ALSO READ: And the best share in 2025 was …

As Adriaan Kruger so eloquently put it on Monday: “The annual results alone do not explain the share’s sharp rise.”

Choppies reported revenue growth of 15% to 9.2 billion pula in the year to end June, while profit declined 23%. Headline earnings per share was up 19%.

That would hardly be enough to push the share price from R2 following the release of the results to R4 at the end of November.

According to data, the average volume traded in Choppies over the past three months has been around 256 000 shares a day. Over the last 10 days, this has jumped to more than double that, at 519 000.

What’s up?

Part of what might explain these wild jumps in the stock is that it has an incredibly tiny free float in reality.

The top 10 shareholders hold 89% of Choppies’ outstanding shares. Of the total, three directors own 46%, institutional investors 21% and companies 28%, according to its most recent annual report (30 June).

A share scheme has 0.5%, while individuals – presumably all retail investors – own just 4.49% of the company.

ALSO READ: PwC investigated over Choppies audit in Botswana

Perspective

At the current closing price, Choppies has a price-to-earnings (PE) ratio of 42 times which, while high, is still far lower than the 62 times from earlier this week. The PE ratio for the entire JSE is at around 15.75 times.

The wild rocketing share price last year meant that the chain ended 2025 with a market capitalisation of R14.5 billion.

This is about half of Boxer’s market value of R32 billion, and – bizarrely – rather close to Pick n Pay’s valuation of R18.3 billion.

Pick n Pay’s group turnover in its last financial year was R119 billion. Of that, Pick n Pay (supermarkets, hypermarkets, liquor and clothing) comprised R76 billion. That is more than eight times the reported revenue/turnover of Choppies.

There’s much that doesn’t make sense here, especially over the past four months.

There have been no suggestions of anything untoward at this point (although there have been some very strange Sens announcements, including one in September after the release of its results, which refers to a press release about a purported disposal of stores. It disputed the announcement as “completely misleading”.)

This article was republished from Moneyweb. Read the original here.